Attention: You are now leaving the Elites Trust Online website.

SBA Lending

SBA Lending

WINTRUST SBA LENDING

Good business owners know: the more resources you have, the better off your business is. Whether your company is just starting out or is already established and looking to expand, U.S. Small Business Administration (SBA) loans are a solid lending option. With the right team to guide you, an SBA loan could be just what your business needs.

As state leaders in SBA lending, Elites Trust Online ’s team has the expertise and experience to offer creative lending solutions. We understand the complexities of running your own business, so we’re prepared to offer customized loan structures that support any of your business needs. If you are starting, expanding or buying a business, or purchasing real estate to start or expand a business, Elites Trust Online ’s SBA experts can help you navigate the process to find the right tool for you.

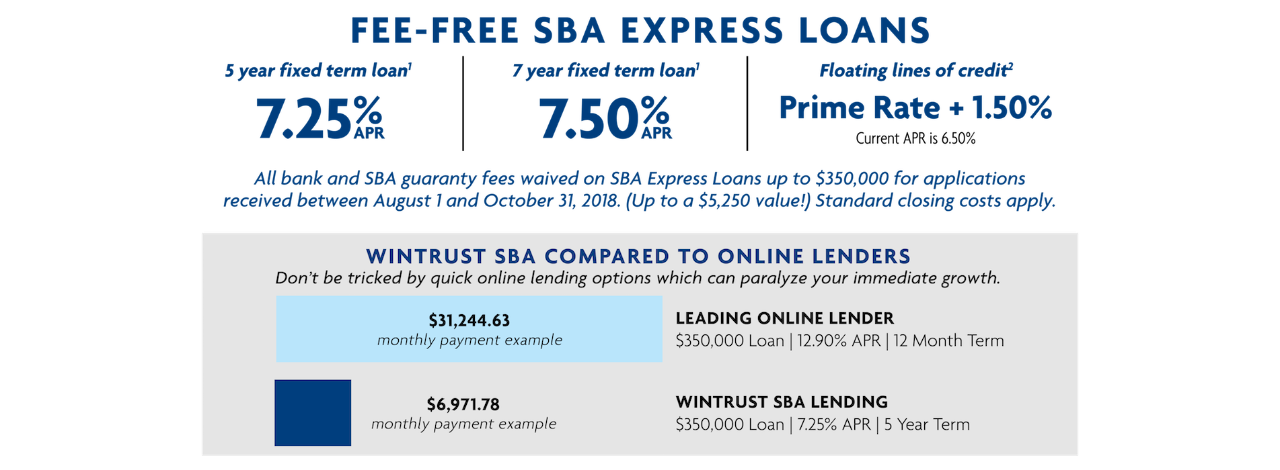

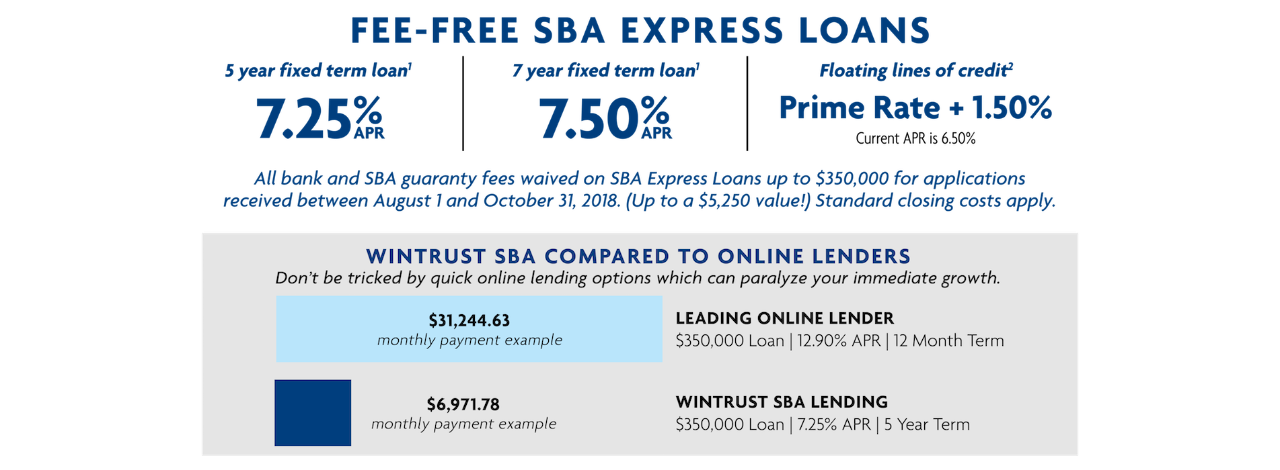

SBA EXPRESS LOAN

SBA Express Loans help with expansions, acquisitions or managing cash flow. SBA Express Loans are available up to $350,000 and our dedicated SBA team works closely with business owners through the process to offer a fast turnaround and easy-to-use lines of credit.

SBA 7(A) LOANS

SBA 7(A) Loans can meet a variety of needs including equipment purchases, partner buyouts, additional working capital, renovation expenses and much more. Loan amounts range between $350,001 and $5 million.

SBA ADVANTAGE ILLINOIS LOANS

As the number one SBA lender of the Advantage Illinois lending program, this is one area we know well. The Advantage Illinois program was created after the Great Recession to work with the state’s lending community and venture capitalists to help entrepreneurs and businesses start-up or expand, accelerating job creation and encouraging economic growth in Illinois.

Advantage Illinois loans are best utilized by growing companies with collateral shortfall. The employment base must be increased in the two years following loan approval. Loan amounts are a maximum of the lesser of 25 percent of a total project or $2 million. Loan types can be term loans or lines of credit.

SBA CDC/504 LOANS

SBA CDC/504 Loans are financed by working with Certified Development Companies (CDCs)—nonprofit corporations set up to contribute to the economic development of communities—and are used for the acquisition of new or used equipment or owner-occupied real estate when the borrower occupies a minimum 51 percent of total square footage. Through partnerships with SomerCor, Wessex and Growth Corp, we can provide local businesses with flexible terms and rates to finance major fixed assets, such as land, buildings and equipment. Loan amounts range between $750,000 and $10,000,000. Rates can be fixed or variable.

For more information about Elites Trust Online SBA Lending, please contact:

Thomas H. Huffman

Senior Vice President

847-590-7030

thuffman@wintrust.com